Mutual funds have steadily become one of the most preferred investment vehicles among individuals seeking to grow their savings with balanced risk. Their connection with the share market provides a bridge for people to invest in equity or debt instruments indirectly. As more investors move away from traditional savings methods, the role of mutual funds has expanded in the broader financial landscape.

In this, we’ll explore the nature of mutual funds, how they work within the dynamics of the share market, and which categories of mutual funds consistently deliver high returns. For new and seasoned investors alike, understanding these popular options could help in making informed financial decisions.

Understanding Mutual Funds

A mutual fund pools money from multiple investors and invests in diversified securities like stocks, bonds, or a mix of both. This approach allows individuals to participate in the share market without the need for direct involvement in buying or managing stocks.

Professionally managed by fund experts, mutual funds aim to achieve a specific investment objective. They provide access to a wide range of assets, helping investors spread risk and gain exposure to different segments of the share market. This structure makes them suitable for individuals who prefer long-term returns without tracking market movements every day.

How Mutual Funds Work with the Share Market

The connection between mutual funds and the share market is crucial. When you invest in an equity-oriented mutual fund, the fund manager allocates your investment to various stocks listed on the stock exchange. As the share market performs, these stocks fluctuate in value, impacting the net asset value (NAV) of the fund.

Debt-oriented mutual funds, on the other hand, are influenced by interest rate movements, credit quality of issuers, and economic factors. Balanced or hybrid mutual funds use a combination of both asset types to generate relatively stable returns across market cycles.

Types of Mutual Funds Offering High Returns

While the returns from mutual funds depend on market conditions, certain categories have shown potential for strong growth over the years. These include:

1. Equity Mutual Funds

Equity mutual funds invest primarily in stocks. They are known for delivering high returns over the long term, although they also carry higher market risk. These funds are suitable for individuals with a higher risk tolerance and a long investment horizon.

2. Small-Cap and Mid-Cap Funds

These mutual funds focus on investing in companies with lower market capitalization. Historically, they offer better growth potential during a bullish share market phase. However, they can be more volatile compared to large-cap funds.

3. Sectoral and Thematic Funds

Such funds invest in specific industries or themes like infrastructure, technology, or renewable energy. If a particular sector performs well in the share market, these mutual funds can generate higher returns. However, sector-based concentration also increases the risk level.

4. Multi-Cap Funds

Multi-cap funds invest across companies of various market capitalizations, balancing the risk and return potential. These funds are ideal for those looking for diversification and steady performance over time.

5. ELSS Funds (Tax-Saving Funds)

Equity Linked Savings Schemes (ELSS) not only offer tax benefits but also invest in equity markets. Their mandatory lock-in period helps investors stay invested for at least three years, which often results in improved returns due to market cycles.

Factors That Influence High Returns in Mutual Funds

Several factors influence how mutual funds perform in relation to the share market:

- Market Trends: Bullish trends generally lead to higher NAVs in equity funds.

- Fund Strategy: A clear investment strategy by the fund manager is key to consistent performance.

- Asset Allocation: Diversified allocation helps in reducing the impact of market fluctuations.

- Expense Ratio: Lower expense ratios contribute to better overall returns.

- Fund Manager Experience: Seasoned fund managers often make better allocation decisions based on economic indicators.

Benefits of Investing in Mutual Funds

Apart from the potential for high returns, mutual funds offer a range of benefits:

- Diversification: Risk is spread across different stocks or bonds.

- Professional Management: Experts manage your investments based on detailed market analysis.

- Liquidity: Most mutual funds offer easy redemption options.

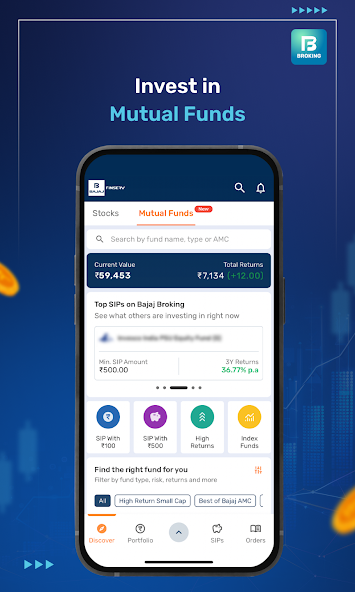

- Affordability: Investors can start with a small amount through Systematic Investment Plans (SIPs).

- Regulated Investment: Mutual funds are governed by strict financial regulations, ensuring investor safety.

Choosing the Right Mutual Fund for High Returns

Investors should keep several points in mind while selecting a mutual fund:

- Investment Horizon: Choose funds based on your long-term or short-term goals.

- Risk Appetite: Higher return potential often comes with higher risk.

- Fund Performance: Look for consistent performance over 3, 5, or 10-year periods.

- Share Market Position: The current state of the share market affects fund performance.

- Review and Rebalance: Periodically monitor and adjust your portfolio as required.

The Role of Mutual Funds in a Share Market Strategy

For those navigating the share market, mutual funds provide structured exposure without the need to pick individual stocks. They simplify investing by offering curated portfolios aligned with market trends. Investors looking for capital growth can rely on mutual funds as part of a larger financial plan that includes retirement, children’s education, or wealth creation.

Mutual funds can also act as a shield against direct volatility. Instead of bearing the brunt of market ups and downs individually, investors in mutual funds benefit from pooled risk and expert management. This approach helps maintain discipline and consistency in investment behavior.

Conclusion

Mutual funds continue to be a strong contender in the investment space, especially for those aiming to benefit from the share market without its complexity. Their diverse structures, risk-managed portfolios, and long-term growth prospects make them a suitable choice for wealth creation.

By selecting the right categories—whether equity, mid-cap, sectoral, or multi-cap—investors can achieve high returns while maintaining a balanced portfolio. Staying invested for the long term and aligning mutual fund choices with individual financial goals enhances the likelihood of success.

As the share market evolves, mutual funds remain an accessible, flexible, and effective tool for generating meaningful returns. For any investor looking to take the next step in financial planning, exploring mutual fund options could be the key to unlocking steady growth and market participation.